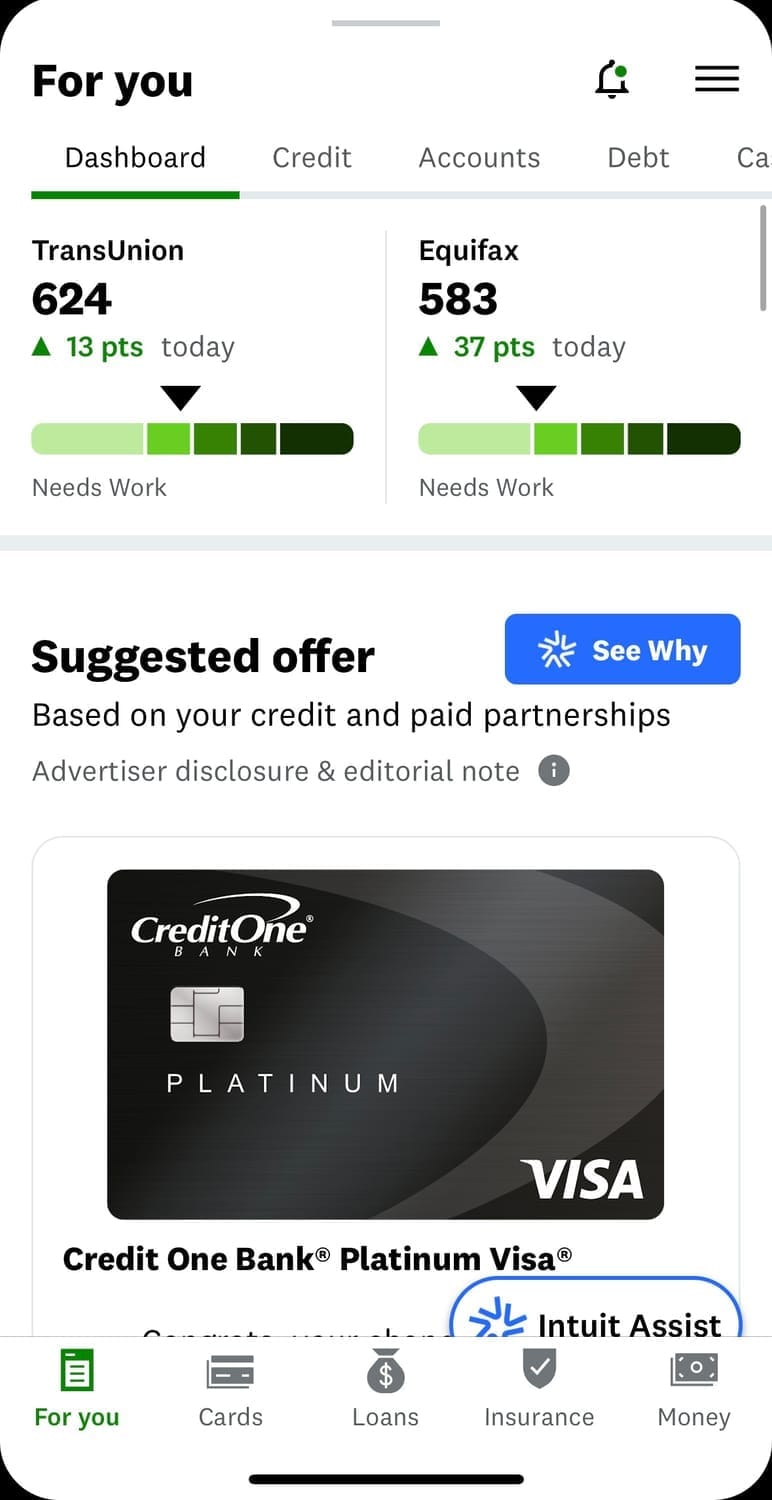

Repair Your Credit, Reclaim Your Future: Fast, Effective Solutions for a Better Financial Life

How It Works

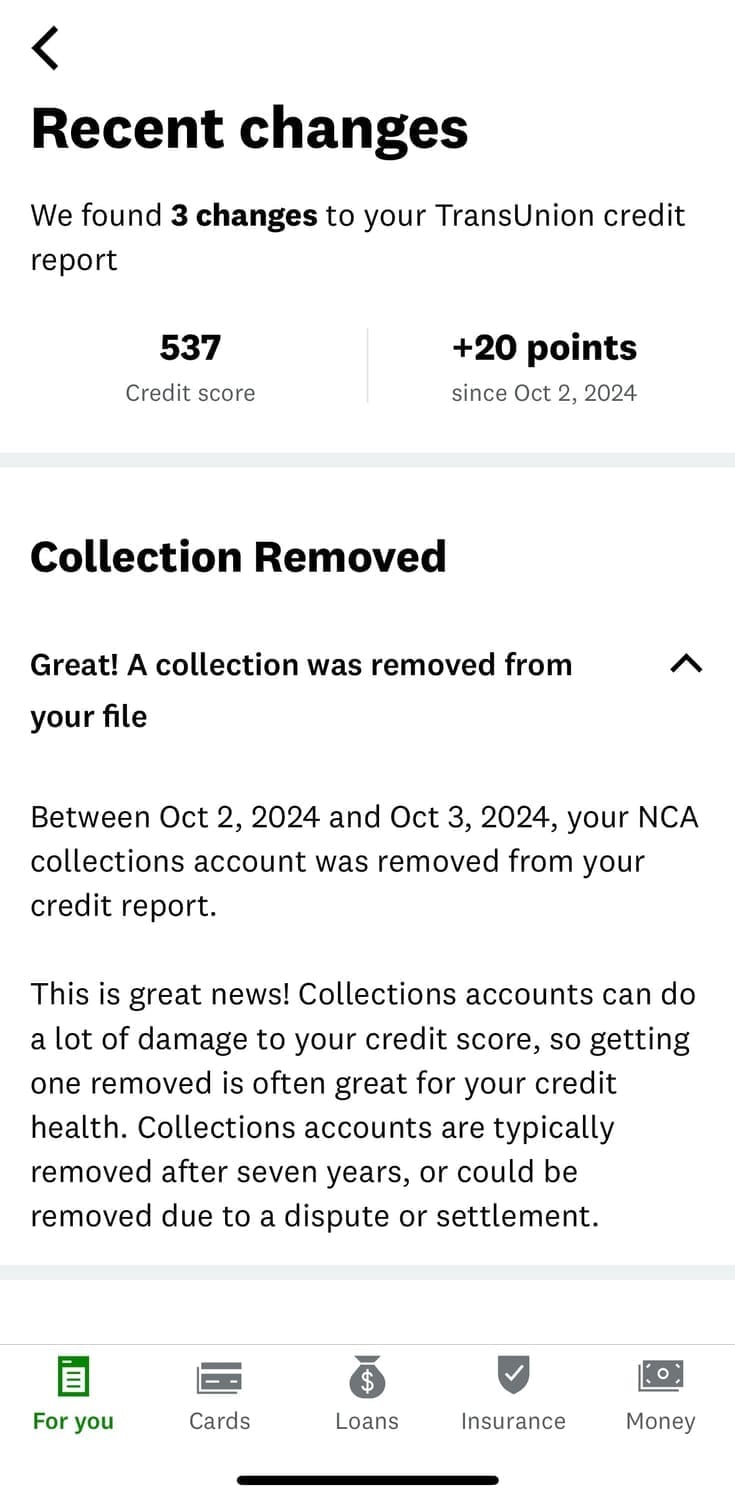

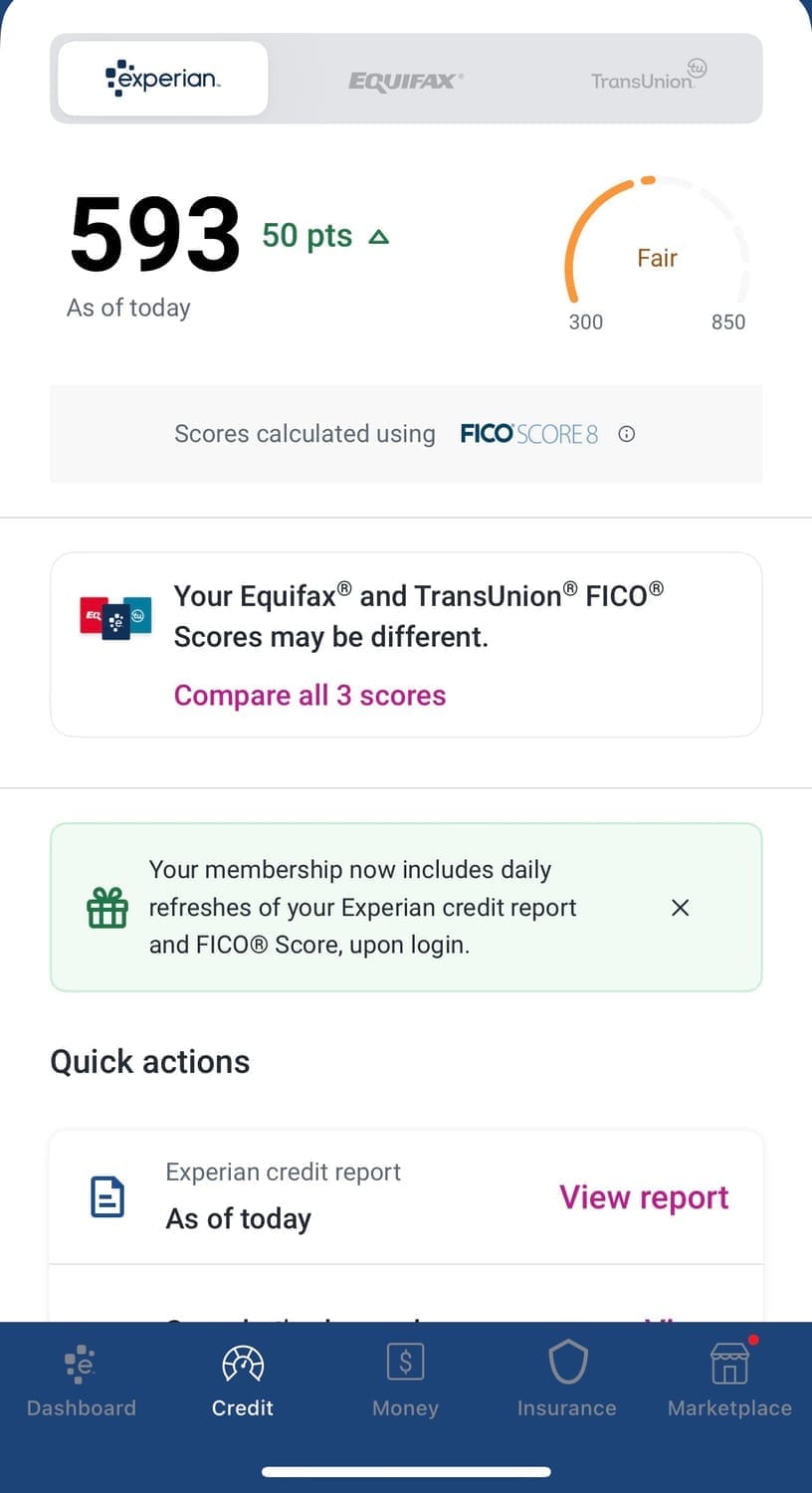

Credit repair involves identifying and disputing errors on your credit report using consumer protection laws. By addressing inaccuracies like late payments or collections, we help improve your credit score, unlocking better financial opportunities.

Step 1:Credit Analysis

We review your credit report to identify errors, inaccuracies, and negative items impacting your score.

Step 2:Dispute & Resolve

Using consumer protection laws, we challenge incorrect entries with credit bureaus and creditors.

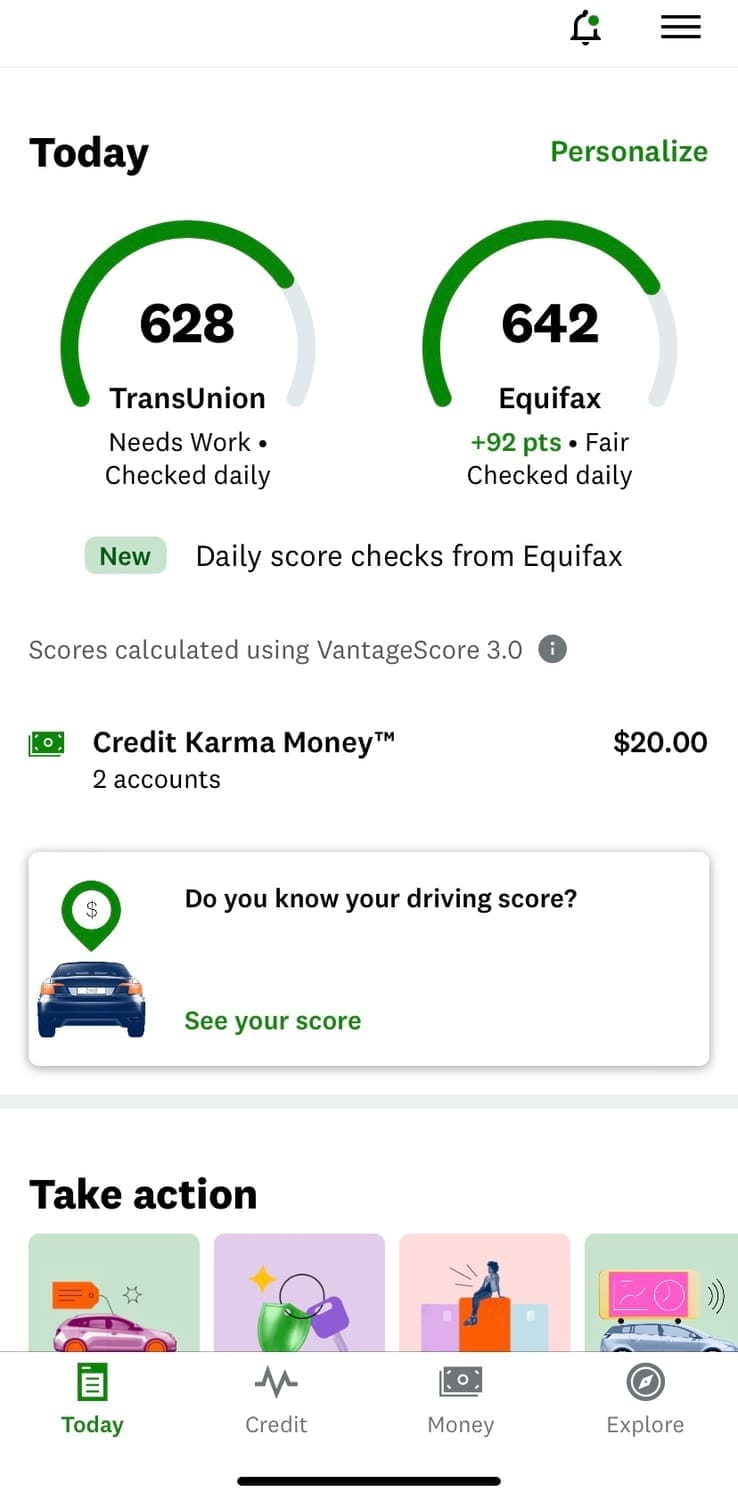

Step 3:Track Progress

Monitor improvements as negative items are corrected, helping you achieve a stronger credit score.

Testimonials

Here’s how we’ve helped people like you achieve their financial goals:

“In just a few months, my credit score improved by over 100 points! Now, I’ve been approved for my first home loan. Thank you!”

Jessica R.

“The team was professional and efficient. They removed incorrect collections from my report, and I’m finally seeing progress with my credit.”

Marcus D.

“I was skeptical at first, but they proved me wrong. I now have the financial freedom I’ve been working toward!”

Tina M.

Consultation Call

Take the first step toward improving your credit with a personalized consultation. During your consultation call, we’ll cover the following topics to understand your unique situation and create a plan tailored for you:

Topic 1: Your Credit Goals

What are your financial dreams? Whether it’s buying a home, qualifying for a loan, or achieving a specific score, we’ll focus on your priorities.

Topic 2: Credit Report Review

We’ll discuss the current state of your credit, identify any errors or negative items, and outline opportunities for improvement.

Topic 3: Our Process Explained

Learn how we leverage laws to dispute inaccurate items, work with creditors, and track progress to boost your credit health.

Topic 4: Your Action Plan

We’ll provide a clear next step to start your credit repair journey and help you achieve long-term financial success.

Frequently Asked Questions

Things People Most Often Ask About

Credit repair is the process of reviewing your credit report to identify and dispute inaccuracies, errors, or unfair negative items that may be lowering your credit score.

The timeline varies depending on your credit situation, but most clients see noticeable improvements within 3 to 6 months.

Not all negative items can be removed. Accurate and legitimate items must remain, but any errors or unverifiable items can be disputed for potential removal.

We prioritize your privacy with secure systems and strict confidentiality practices to protect your data at every step.

Removing inaccuracies and addressing negative items can improve your credit score over time, but results depend on the specific issues on your report.

Yes! Credit repair is backed by federal laws like the Fair Credit Reporting Act (FCRA), which ensures your right to dispute inaccuracies on your credit report.

Yes, you can dispute inaccuracies on your own, but many people choose professional services to save time, avoid errors, and get expert guidance.

Simply contact us for a free consultation, and we’ll begin by reviewing your credit report to create a customized plan for improvement.

JWG © 2025. All Rights Reserved.

100% Money Back Guarantee

Just enter the details below, and watch how your business grow

You're agreeing to our Terms & Conditions. We won't sell your info ever. We will only email you relevant offers and info. Seriously. View our full Privacy Policy to see why. Unsubscribe at any time.